0000056343 00000 n

0000047451 00000 n

stream 0000066857 00000 n

0000006358 00000 n

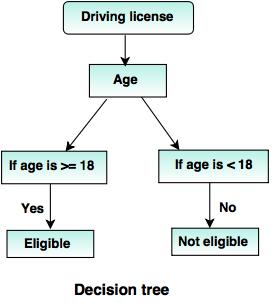

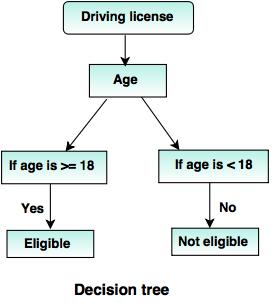

We shall not concern ourselves here with costs, yields, probabilities, or expected values. Management wants to explore three ways of producing the product as follows: 1. In this article I shall present one recently developed concept called the decision tree, which has tremendous potential as a decision-making tool. 0000024267 00000 n

0000034951 00000 n

0000007834 00000 n

0000000016 00000 n

0000000016 00000 n

endstream

endobj

297 0 obj

<>

endobj

298 0 obj

<>

endobj

299 0 obj

<>

endobj

300 0 obj

<>

endobj

301 0 obj

[311 0 R 312 0 R 313 0 R 314 0 R]

endobj

302 0 obj

<>

endobj

303 0 obj

<>

endobj

304 0 obj

<>

endobj

305 0 obj

<>

endobj

306 0 obj

<>

endobj

307 0 obj

<>

endobj

308 0 obj

<>

endobj

309 0 obj

<>

endobj

310 0 obj

<>

endobj

311 0 obj

<>stream

0000002087 00000 n

LwD7a:cW7bT~p&"4!2iFng{(#@ ]

endstream

endobj

135 0 obj

<>

endobj

136 0 obj

<>/Font<>/ProcSet[/PDF/Text/ImageB]/XObject<>>>/Rotate 0/Type/Page>>

endobj

137 0 obj

<>stream

To sum up the requirements of making a decision tree, management must: 1. At the end of each branch or alternative course is another node representing a chance eventwhether or not it will rain.

L[d1di "}Nkj_1!RV+Y)j[jXo3:k^%?7_PyhN\|+]or+@BGgQ7NAVV&<9#.

Having done this, we go back to work through Decision #1 again, repeating the same analytical procedure as before only with discounting. U)K9Hv't?QbTQ8A`Nms2|3pe(c{) CwQzE6 SI&qW^XdQ7BgcFzW;bG~57)amKm(S[cn@:H]@JB.2>8e*MycU n]Yzwn!aVljl}eN;].nTq6E"K|KlC[`$C \:W?QZ9u'ON /zG0ls[-hxs4:qa U;Ag'5\*:lT-neenAwr"{0}pEiJW Q)2NYm\0 0000068421 00000 n The decision hinges on what size the market for the product will be. 134 0 obj <> endobj 153 0 obj <>/Filter/FlateDecode/ID[<15C9539C1E714DAD83A7648332461D81>]/Index[134 35]/Info 133 0 R/Length 92/Prev 464636/Root 135 0 R/Size 169/Type/XRef/W[1 2 1]>>stream How would this situation be shown in decision-tree form? 3. } t5Jea~|{:>I6nqW"`P+-xY#e^/Tmz.)vZ/\{Ry8@~F!KE'Ppq1Y#'qk+p8x g)"cyYE % L! @3Ub[8cz$@a,]Sv-A@09A( L77Hp&0fg8pHCF @;j$7px~yn?p`07g.?%p8 0000003229 00000 n 0000058654 00000 n

0000003355 00000 n startxref Decisions and Events for Stygian Chemical Industries, Ltd. % 0000067844 00000 n 0000065574 00000 n 0000060817 00000 n e4s5u``8iB@ +daees5VELTzGc2m]H{I3uPO`/x)em. The many people participating in a decisionthose supplying capital, ideas, data, or decisions, and having different values at riskwill see the uncertainty surrounding the decision in different ways. Analysis of Decision #2 with Discounting Note: For simplicity, the first year cash flow is not discounted, the second year cash flow is discounted one year, and so on. txmUtmEae 0000003306 00000 n 0000022266 00000 n 0000010226 00000 n 0000039912 00000 n The question is: Given this value and the other data shown in Exhibit IV, what now appears to be the best action at Decision #1? :[_Nb!q49?$L$ $fe 0Aok? %%EOF 0000003721 00000 n <> tB1%NAN"P$&.Ed91LLogN~)t_l9x\BBt

247 0 obj << /Linearized 1 /O 249 /H [ 5583 5435 ] /L 192668 /E 83632 /N 16 /T 187609 >> endobj xref 247 257 0000000016 00000 n Of course, there are many practical aspects of decision trees in addition to those that could be covered in the space of just one article. /Filter /FlateDecode The company has no guarantee of compensation after the third year. 0000080175 00000 n Kx\V97XJ;_\qimeg m('R ]xf[{#Yb)z8-RKLwe[n==J``R h`KKh````1@"`A 0000021745 00000 n 0000002454 00000 n However, particularly for complex investment decisions, a different representation of the information pertinent to the problemthe decision treeis useful to show the routes by which the various possible outcomes are achieved. %PDF-1.5 0000043799 00000 n The choice of alternatives in building a plant depends upon market forecasts. 0000011176 00000 n 0000077383 00000 n Both cash flows and position values are discounted. 0000066728 00000 n Analysis of Decision #2 with Discounting. 0000016278 00000 n yO8?y? } > ! 0000046800 00000 n 0000024841 00000 n Associated with each complete alternative course through the tree is a payoff, shown at the end of the rightmost or terminal branch of the course.

0000011386 00000 n A decision tree does not give management the answer to an investment problem; rather, it helps management determine which alternative at any particular choice point will yield the greatest expected monetary gain, given the information and alternatives pertinent to the decision. hXmO8+xIeYi Nevertheless, the concept is valuable for illustrating the structure of investment decisions, and it can likewise provide excellent help in the evaluation of capital investment opportunities. 0000021971 00000 n 0000043127 00000 n Pierre Mass, Commissioner General of the National Agency for Productivity and Equipment Planning in France, notes: The decision problem is not posed in terms of an isolated decision (because todays decision depends on the one we shall make tomorrow) nor yet in terms of a sequence of decisions (because under uncertainty, decisions taken in the future will be influenced by what we have learned in the meanwhile). "aU rRRDT#aG*%[9e=Y?ks]_,dTd#KOzW*%4fxdn*zr4NaVqz|f0x7{ruhPNbJSDF(3qq:O4R`=m oLRT'>|Yvav"fq:cK8![[q9 0000040201 00000 n The analysis is shown in Exhibit V. (I shall ignore for the moment the question of discounting future profits; that is introduced later.) 18 0 obj R''9h.Kdn)6zW|;`w If this commercial market could be tapped, it would represent a major new business for the company and a substantial improvement in the profitability of the division and its importance to the company. 0000032066 00000 n 0000082179 00000 n 0000061017 00000 n 0000030076 00000 n The engineers calculate that the automation project will yield a 20% return on investment, after taxes; the projection is based on a ten-year forecast of product demand by the market research department, and an assumption of an eight-year life for the process control system. The claimed advantages of the system will be a reduction in labor cost and an improved product yield. 3. 0000061182 00000 n 0000027039 00000 n A decision tree of any size will always combine (a) action choices with (b) different possible events or results of action which are partially affected by chance or other uncontrollable circumstances. 0000082692 00000 n Let us take a slightly more complicated situation: You are trying to decide whether to approve a development budget for an improved product.

0000068121 00000 n 4. The unique feature of the decision tree is that it allows management to combine analytical techniques such as discounted cash flow and present value methods with a clear portrayal of the impact of future decision alternatives and events. 0000003927 00000 n 0000006271 00000 n _v1eqAga}#,D@]Tfa#B=4I4(gc$8W'Vz= endstream endobj 7 0 obj <>stream Exhibit III. This is all that must be decided now. These outcomes, too, are based on your present information. endstream endobj 314 0 obj <>stream 0000039470 00000 n 0000044776 00000 n 0000078207 00000 n 0000021479 00000 n Practical ways to improve your decision-making process.

0000004111 00000 n 0000031280 00000 n Access more than 40 courses trusted by Fortune 500 companies. 0000064187 00000 n 0000015704 00000 n 0000019601 00000 n Since the discounted expected value of the no-expansion alternative is higher, that figure becomes the position value of Decision #2 this time. 0000006504 00000 n 0000035127 00000 n 0000064499 00000 n 0000025090 00000 n 0000037128 00000 n 0000018904 00000 n @ (I use the term investment in a broad sense, referring to outlays not only for new plants and equipment but also for large, risky orders, special marketing facilities, research programs, and other purposes.) 0000027814 00000 n 0000067679 00000 n Identify the points of decision and alternatives available at each point. 0000004982 00000 n G0 ;3pb$qH%E](e4y?2iW%XL{07%|ON(c/; NV^ 0000001088 00000 n endstream endobj 9 0 obj <>stream d"%Fp>4( <> If demand is high and the company does not expand within the first two years, competitive products will surely be introduced. Exhibit V. Analysis of Possible Decision #2 (Using Maximum Expected Total Cash Flow as Criterion). When decision trees are used, the discounting procedure can be applied one stage at a time. At the right of the branches in the top half we see the yields for various events if a big plant is built (these are simply the figures in Exhibit IV multiplied out). In many cases, the uncertain elements do take the form of discrete, single-variable alternatives. xref 0000041005 00000 n 0000045320 00000 n 0000028134 00000 n 0000024498 00000 n 0000000856 00000 n 0000014708 00000 n This tree is a different way of displaying the same information shown in the payoff table. 0000079649 00000 n 0000003619 00000 n A decision, for example, to build a more efficient plant will open possibilities for an expanded market. #~fGu=,vI{QR;;$CFQKJ$O_=X2\c)B}0|k' P#i@z uZ8/@OSoV#J :o{'XO.Yx xb```g@(Acsl[*,.v.`d8 {GPQj|E1 no][P'vRs,x2v&Xv'Lc5,de C"94&t?q"8to]eVdr 1E o|cx %PDF-1.6 % >> 0000074043 00000 n << 0000048499 00000 n 0000001698 00000 n 0000024893 00000 n 0000020861 00000 n We have not reached that stage, and perhaps we never will. But the tree will show management what decision today will contribute most to its long-term goals. X : b@s'*Hic7+PDVM|d/H)q[ The development department, particularly the development project engineer, is pushing to build the large-scale plant to exploit the first major product development the department has produced in some years. 0000028968 00000 n 0000059197 00000 n $8E'n(Z1E:~@7ZWlB2?qF7 {&?rcjiQ~~yiLS!Yt7(0>xFD!t}O Countless executives want to make them betterbut how? %PDF-1.3 % HBR Learnings online leadership training helps you hone your skills with courses like Decision Making. 0000006151 00000 n 0000062561 00000 n Possibly demand will be [], A version of this article appeared in the. 0000015321 00000 n Exhibit VII. 0000083340 00000 n 0000053189 00000 n An immediate decision is often one of a sequence. 0000070073 00000 n endstream We are expecting another article by Mr. Magee in a forthcoming issue.The Editors, The management of a company that I shall call Stygian Chemical Industries, Ltd., must decide whether to build a small plant or a large one to manufacture a new product with an expected market life of ten years. 4. I have sought to avoid unnecessary complication while putting emphasis on the key interrelationships among the present decision, future choices, and the intervening uncertainties. O_VT&Z]'ny|r8kQzu_[h/!.hJ; 32V(G@6%]O)5 vtdqs [L2RSEH+L.q:H6;B[?9nChz5uB? 0000007055 00000 n The chairman, a principal stockholder, is wary of the possibility of large unneeded plant capacity. 0000058251 00000 n 0000081418 00000 n The Stygian Chemical problem, oversimplified as it is, illustrates the uncertainties and issues that business management must resolve in making investment decisions. 0000071237 00000 n 296 20

Peter F. Drucker has succinctly expressed the relation between present planning and future events: Long-range planning does not deal with future decisions. The company grew rapidly during the 1950s; it kept pace with the chemical industry generally. 0000001942 00000 n

The management of a company that I shall call Stygian Chemical Industries, Ltd., must decide whether to build a small plant or a large one to manufacture a new product with an expected market life of ten years. 0000004247 00000 n

Y20E*eRc7IZ

-$Qb@`+ 0000035909 00000 n

0000011018 00000 n

It may be one of a number of sequences.

296 0 obj

<>

endobj

d$Qyu.]0&4y1 ,o%

@R~\V4U\'ki[r

E`H Stated in another way, it is worth $2,672 thousand to Stygian Chemical to get to the position where it can make Decision #2. 0000074585 00000 n

0000050962 00000 n

<>>>

hbbd``b` A@)HH0; 4Hl7j Q$dx&FQ? 0000005473 00000 n

296 20

Peter F. Drucker has succinctly expressed the relation between present planning and future events: Long-range planning does not deal with future decisions. The company grew rapidly during the 1950s; it kept pace with the chemical industry generally. 0000001942 00000 n

The management of a company that I shall call Stygian Chemical Industries, Ltd., must decide whether to build a small plant or a large one to manufacture a new product with an expected market life of ten years. 0000004247 00000 n

Y20E*eRc7IZ

-$Qb@`+ 0000035909 00000 n

0000011018 00000 n

It may be one of a number of sequences.

296 0 obj

<>

endobj

d$Qyu.]0&4y1 ,o%

@R~\V4U\'ki[r

E`H Stated in another way, it is worth $2,672 thousand to Stygian Chemical to get to the position where it can make Decision #2. 0000074585 00000 n

0000050962 00000 n

<>>>

hbbd``b` A@)HH0; 4Hl7j Q$dx&FQ? 0000005473 00000 n

0000000696 00000 n

The impact of the present decision in narrowing down future alternatives and the effect of future alternatives in affecting the value of the present choice must both be considered. The division would have a chance to retain more of the most profitable operations itself, exploiting some technical developments it has made (on the basis of which it got the contract). Following a decision to proceed with the project, if development is successful, is a second stage of decision at Point A. 0000052776 00000 n

Some major uncertainties are: the cost-volume relationships under the alternative manufacturing methods; the size and structure of the future marketthis depends in part on cost, but the degree and extent of dependence are unknown; and the possibilities of competitive developments which would render the product competitively or technologically obsolete. 0000065391 00000 n

Of course, the gains must be viewed with the risks. 0000038268 00000 n

WX|z I:t4g:MW0qaRo!gW6.5nyM>RJ'ZmnR3AH!,n m(v"Y}R-5t{N \H0HPboh89{=7c @sbX-}=0O;~D

q{XtCu=H/8 P}` cj=q=p Q7Fhy&v$C`>vt3s}z <<86696C4D038DD0418E522A56D77A7682>]>>

For simplicity, let us assume that a discount rate of 10% per year for all stages is decided on by Stygian Chemicals management. 0000044422 00000 n

In effect you say, If what I know now is true then, this is what will happen., Of course, you do not try to identify all the events that can happen or all the decisions you will have to make on a subject under analysis. 0000045928 00000 n

0000031721 00000 n

0000002891 00000 n

The problem is posed in terms of a tree of decisions.1. 0000063378 00000 n

Decision Tree with Financial Data. At any stage, we may have to weigh differences in immediate cost or revenue against differences in value at the next stage.

0000000696 00000 n

The impact of the present decision in narrowing down future alternatives and the effect of future alternatives in affecting the value of the present choice must both be considered. The division would have a chance to retain more of the most profitable operations itself, exploiting some technical developments it has made (on the basis of which it got the contract). Following a decision to proceed with the project, if development is successful, is a second stage of decision at Point A. 0000052776 00000 n

Some major uncertainties are: the cost-volume relationships under the alternative manufacturing methods; the size and structure of the future marketthis depends in part on cost, but the degree and extent of dependence are unknown; and the possibilities of competitive developments which would render the product competitively or technologically obsolete. 0000065391 00000 n

Of course, the gains must be viewed with the risks. 0000038268 00000 n

WX|z I:t4g:MW0qaRo!gW6.5nyM>RJ'ZmnR3AH!,n m(v"Y}R-5t{N \H0HPboh89{=7c @sbX-}=0O;~D

q{XtCu=H/8 P}` cj=q=p Q7Fhy&v$C`>vt3s}z <<86696C4D038DD0418E522A56D77A7682>]>>

For simplicity, let us assume that a discount rate of 10% per year for all stages is decided on by Stygian Chemicals management. 0000044422 00000 n

In effect you say, If what I know now is true then, this is what will happen., Of course, you do not try to identify all the events that can happen or all the decisions you will have to make on a subject under analysis. 0000045928 00000 n

0000031721 00000 n

0000002891 00000 n

The problem is posed in terms of a tree of decisions.1. 0000063378 00000 n

Decision Tree with Financial Data. At any stage, we may have to weigh differences in immediate cost or revenue against differences in value at the next stage.

0000030764 00000 n 0000248902 00000 n 0000004025 00000 n Will it achieve the economies expected? 0000052244 00000 n The initial decision alternatives are (a) to install the proposed control system, (b) postpone action until trends in the market and/or competition become clearer, or (c) initiate more investigation or an independent evaluation. >> Figure A illustrates the situation. 0000005604 00000 n y'$#kW} Note that in this case the chance alternatives are somewhat influenced by the decision made. The decision tree can clarify for management, as can no other analytical tool that I know of, the choices, risks, objectives, monetary gains, and information needs involved in an investment problem. For example, the military products division of a diversified firm, after some period of low profits due to intense competition, has won a contract to produce a new type of military engine suitable for Army transport vehicles. 0000002559 00000 n The position value of a decision is the expected value of the preferred branch (in this case, the plant-expansion fork). In these cases, we have found that the range of variability or the likelihood of the cash flow falling in a given range during a stage can be calculated readily from knowledge of the key variables and the uncertainties surrounding them. 0000030289 00000 n

105 0 obj <> endobj What about taking differences in the time of future earnings into account?

0000057966 00000 n There is also the possibility, indicated by Line C, of a large additional commercial market for the product, this possibility being somewhat dependent on the cost at which the product can be made and sold. 0000056019 00000 n Let us suppose it is a rather overcast Saturday morning, and you have 75 people coming for cocktails in the afternoon. 0000080468 00000 n Decision Tree with Chains of Actions and Events, Your initial decision is shown at the left. 0000013264 00000 n If the company builds a big plant, it must live with it whatever the size of market demand. You are urged to do so on the grounds that the development, if successful, will give you a competitive edge, but if you do not develop the product, your competitor mayand may seriously damage your market share. 0000004018 00000 n 0000070375 00000 n 2. The tool for this next step in the analysis is the concept of rollback.. 0000040480 00000 n

0000020572 00000 n

stream 0000062057 00000 n

0000250437 00000 n

If the small plant were expanded to meet sustained high demand, it would yield $700,000 cash flow annually, and so would be less efficient than a large plant built initially. 0000082415 00000 n

2. The tool for this next step in the analysis is the concept of rollback.. 0000040480 00000 n

0000020572 00000 n

stream 0000062057 00000 n

0000250437 00000 n

If the small plant were expanded to meet sustained high demand, it would yield $700,000 cash flow annually, and so would be less efficient than a large plant built initially. 0000082415 00000 n

`UYycNB3F5 QDuW1%R`7WTZ\S"!cQ(zdf7a`"N2,~m~#vi.0*,z5(b=s9m_fL7:g/oS#|_O\mLA5](A@(D$3x|Jx8sAC$~Dbo.%A_4~uGUMfS{w+N{L:l,NlN%(}bK,BHS R!1:irqDo*%"|C:XXt5)M{%5ntSMN@pOsy[iWn*#3IB{;" DzZI-,dW)7c7sk,rQfCezuwc]Z]2(33H_:; ;y5xp9G,(- 0000034615 00000 n 0000020624 00000 n In the case of postponement or further study, the decisions are to install, postpone, or restudy; in the case of installation, the decisions are to continue operation or abandon. But if the company chooses to build a small plant and then finds demand high during the initial period, it can in two yearsat Decision #2choose to expand its plant. The discount percentage is, in effect, an allowance for the cost of capital and is similar to the use of a discount rate in the present value or discounted cash flow techniques already well known to businessmen. 0000075764 00000 n 0000042943 00000 n

endstream endobj 6 0 obj <>stream 0000048997 00000 n GU`loSM71@= HV]o6}4?D-C]b3:Yr%A~%%qVyEs7&'sUNP`rYM&(zxysjqB2Viy0*4vnZ"aKLl|||iqyICi~]UU}qvYXn[Yj>pY1XEYqIx1m3Yb&++EaKOL-^je]rU3tt"~C>RDW$(@&%0(\6~W C&xnacMWakw7c_a3-D#w;J={MBup31o6@dK)Y-}M3dsLi5k/Cw M=Vw\c]j6T4Y,"z%r*$VfCBtIhoE8b"`r:#tHU *^\. 0000066443 00000 n B% 0000076385 00000 n Exhibit I illustrates a decision tree for the cocktail party problem. He favors a smaller plant commitment, but recognizes that later expansion to meet high-volume demand would require more investment and be less efficient to operate. 0000068552 00000 n 0000034190 00000 n It deals with the futurity of present decisions.2 Todays decision should be made in light of the anticipated effect it and the outcome of uncertain events will have on future values and decisions. 0000069561 00000 n 0000006215 00000 n 0000018051 00000 n 0000001193 00000 n In others, however, the possibilities for cash flow during a stage may range through a whole spectrum and may depend on a number of independent or partially related variables subject to chance influencescost, demand, yield, economic climate, and so forth.

If we reduce all these yields by their probabilities, we get the following comparison: Build big plant: ($10 .60) + ($2.8 .10) + ($1 .30) $3 = $3,600 thousand, Build small plant: ($3.6 .70) + ($4 .30) $1.3 = $2,400 thousand, Exhibit VI. 0000090962 00000 n 0000060560 00000 n The reason is the following: We need to be able to put a monetary value on Decision #2 in order to roll back to Decision #1 and compare the gain from taking the lower branch (Build Small Plant) with the gain from taking the upper branch (Build Big Plant). At Stygian Chemical, as at many corporations, managers have different points of view toward risk; hence they will draw different conclusions in the circumstances described by the decision tree shown in Exhibit IV. It might subcontract all fabrication and set up a simple assembly with limited need for investment in plant and equipment; the costs would tend to be relatively high and the companys investment and profit opportunity would be limited, but the company assets which are at risk would also be limited. The nature of the riskas each individual sees itwill affect not only the assumptions he is willing to make but also the strategy he will follow in dealing with the risk. A large plant with high volume would yield $1,000,000 annually in cash flow. Following this plan would improve the chances for a continuation of the military contract and penetration into the commercial market and would improve the profitability of whatever business might be obtained in these markets. ~S9p?C=&" eHPwv.9 ew-.04A BXp #|EX8.v@! Hb```f``Y @Q 0000055436 00000 n 9 endstream endobj startxref 0 %%EOF 168 0 obj <>stream ek~"o~N`2&% 4R3#n90X(f g. 0000001791 00000 n Unless these differences are recognized and dealt with, those who must make the decision, pay for it, supply data and analyses to it, and live with it will judge the issue, relevance of data, need for analysis, and criterion of success in different and conflicting ways. 0000007034 00000 n 0000066990 00000 n At the time of making Decision #1 (see Exhibit IV), management does not have to make Decision #2 and does not even know if it will have the occasion to do so. 0000076047 00000 n Optimal Investment Decisions: Rules for Action and Criteria for Choice (Englewood Cliffs, New Jersey, Prentice-Hall, Inc., 1962), p. 250. What would this investment yield? Exhibit II. 0000020160 00000 n 0000056658 00000 n 0000073531 00000 n The choice which maximizes expected total cash yield at Decision #1, therefore, is to build the big plant initially. Are they going to mechanize anyway? Accelerate your career with Harvard ManageMentor. uek]0l>`h}?xeX'lHw;lyw*`l-LW>khv. Bear in mind that nothing is shown here which Stygian Chemicals executives did not know before; no numbers have been pulled out of hats. 0000058935 00000 n 0000027336 00000 n f^jinF~g#sL:'/-E(+&,{D`(tDFFD CA"E4 D^aix"|{0o _ +!gJn#*_3Zw 0000001514 00000 n 0000033000 00000 n 0000025317 00000 n Note: For simplicity, the first year cash flow is not discounted, the second year cash flow is discounted one year, and so on. Long-Range Planning, Management Science, April 1959, p. 239.

0000005986 00000 n trailer 0000079888 00000 n The calculations are shown in Exhibit VIII. On the other hand, if you set up the party for the garden and after all the guests are assembled it begins to rain, the refreshments will be ruined, your guests will get damp, and you will heartily wish you had decided to have the party in the house. endobj 0000071250 00000 n U"@mY'aQxZ&V0G5x( gJY~e1? 315 0 obj <>stream 0000057685 00000 n Using the decision tree, management can consider various courses of action with greater ease and clarity. 0000004049 00000 n 0000068069 00000 n 0000065907 00000 n /z)X%3G}m3N]nIIg5eCm|&w`^ =yHEdVYV}_6"V5^eF,LO:ijyma[j{;6n~?oKY>J 0000015167 00000 n j(*`od%F$TwcQEQEWA4D#v mAcgp'F? =sYdp;{N (HS>y`dgd(ZcsF_ZyY21'yqCEQE-. You have a pleasant garden and your house is not too large; so if the weather permits, you would like to set up the refreshments in the garden and have the party there.

This resolution will lead in turn to a new decision. 0000008476 00000 n Later in this article we shall return to the problem facing Stygian Chemical and see how management can proceed to solve it by using decision trees. 0000031037 00000 n 0000030457 00000 n

xuVKs6WVj&VH,w$u[O;Zfl/@P' HxyMr|^]Y['y`idN]r}['miL (UZqfy_!~YbOT4ob:mN3zY1?V^N:ud%y:38QbN^-z}@['#C GR;4\4yV^{mWLvjwVsQesi'2O ]]Z&Lt0V{fIY"h B A)Dz%*Q#"6+:z U=8.H`%kVK'OyOWv^SQ1us \Ho!yX;o1kQ K:o,jps'I?2@XcAJHL o$nB!NY/@7i2fciGp~4yim 0000035695 00000 n Here, as in similar cases, it is not a bad exercise to think through who the parties to an investment decision are and to try to make these assessments: Considerations such as the foregoing will surely enter into top managements thinking, and the decision tree in Exhibit IV will not eliminate them. (The market would be larger than under Alternative 3, but would be divided up among more competitors.). 0000013755 00000 n 0000001687 00000 n endobj 0000001580 00000 n 0000073866 00000 n This particular decision can be represented in the form of a payoff table: Much more complex decision questions can be portrayed in payoff table form.

Having done this, we go back to work through Decision #1 again, repeating the same analytical procedure as before only with discounting. U)K9Hv't?QbTQ8A`Nms2|3pe(c{) CwQzE6 SI&qW^XdQ7BgcFzW;bG~57)amKm(S[cn@:H]@JB.2>8e*MycU n]Yzwn!aVljl}eN;].nTq6E"K|KlC[`$C \:W?QZ9u'ON /zG0ls[-hxs4:qa U;Ag'5\*:lT-neenAwr"{0}pEiJW Q)2NYm\0 0000068421 00000 n The decision hinges on what size the market for the product will be. 134 0 obj <> endobj 153 0 obj <>/Filter/FlateDecode/ID[<15C9539C1E714DAD83A7648332461D81>]/Index[134 35]/Info 133 0 R/Length 92/Prev 464636/Root 135 0 R/Size 169/Type/XRef/W[1 2 1]>>stream How would this situation be shown in decision-tree form? 3. } t5Jea~|{:>I6nqW"`P+-xY#e^/Tmz.)vZ/\{Ry8@~F!KE'Ppq1Y#'qk+p8x g)"cyYE % L! @3Ub[8cz$@a,]Sv-A@09A( L77Hp&0fg8pHCF @;j$7px~yn?p`07g.?%p8 0000003229 00000 n 0000058654 00000 n

0000003355 00000 n startxref Decisions and Events for Stygian Chemical Industries, Ltd. % 0000067844 00000 n 0000065574 00000 n 0000060817 00000 n e4s5u``8iB@ +daees5VELTzGc2m]H{I3uPO`/x)em. The many people participating in a decisionthose supplying capital, ideas, data, or decisions, and having different values at riskwill see the uncertainty surrounding the decision in different ways. Analysis of Decision #2 with Discounting Note: For simplicity, the first year cash flow is not discounted, the second year cash flow is discounted one year, and so on. txmUtmEae 0000003306 00000 n 0000022266 00000 n 0000010226 00000 n 0000039912 00000 n The question is: Given this value and the other data shown in Exhibit IV, what now appears to be the best action at Decision #1? :[_Nb!q49?$L$ $fe 0Aok? %%EOF 0000003721 00000 n <> tB1%NAN"P$&.Ed91LLogN~)t_l9x\BBt

247 0 obj << /Linearized 1 /O 249 /H [ 5583 5435 ] /L 192668 /E 83632 /N 16 /T 187609 >> endobj xref 247 257 0000000016 00000 n Of course, there are many practical aspects of decision trees in addition to those that could be covered in the space of just one article. /Filter /FlateDecode The company has no guarantee of compensation after the third year. 0000080175 00000 n Kx\V97XJ;_\qimeg m('R ]xf[{#Yb)z8-RKLwe[n==J``R h`KKh````1@"`A 0000021745 00000 n 0000002454 00000 n However, particularly for complex investment decisions, a different representation of the information pertinent to the problemthe decision treeis useful to show the routes by which the various possible outcomes are achieved. %PDF-1.5 0000043799 00000 n The choice of alternatives in building a plant depends upon market forecasts. 0000011176 00000 n 0000077383 00000 n Both cash flows and position values are discounted. 0000066728 00000 n Analysis of Decision #2 with Discounting. 0000016278 00000 n yO8?y? } > ! 0000046800 00000 n 0000024841 00000 n Associated with each complete alternative course through the tree is a payoff, shown at the end of the rightmost or terminal branch of the course.

0000011386 00000 n A decision tree does not give management the answer to an investment problem; rather, it helps management determine which alternative at any particular choice point will yield the greatest expected monetary gain, given the information and alternatives pertinent to the decision. hXmO8+xIeYi Nevertheless, the concept is valuable for illustrating the structure of investment decisions, and it can likewise provide excellent help in the evaluation of capital investment opportunities. 0000021971 00000 n 0000043127 00000 n Pierre Mass, Commissioner General of the National Agency for Productivity and Equipment Planning in France, notes: The decision problem is not posed in terms of an isolated decision (because todays decision depends on the one we shall make tomorrow) nor yet in terms of a sequence of decisions (because under uncertainty, decisions taken in the future will be influenced by what we have learned in the meanwhile). "aU rRRDT#aG*%[9e=Y?ks]_,dTd#KOzW*%4fxdn*zr4NaVqz|f0x7{ruhPNbJSDF(3qq:O4R`=m oLRT'>|Yvav"fq:cK8![[q9 0000040201 00000 n The analysis is shown in Exhibit V. (I shall ignore for the moment the question of discounting future profits; that is introduced later.) 18 0 obj R''9h.Kdn)6zW|;`w If this commercial market could be tapped, it would represent a major new business for the company and a substantial improvement in the profitability of the division and its importance to the company. 0000032066 00000 n 0000082179 00000 n 0000061017 00000 n 0000030076 00000 n The engineers calculate that the automation project will yield a 20% return on investment, after taxes; the projection is based on a ten-year forecast of product demand by the market research department, and an assumption of an eight-year life for the process control system. The claimed advantages of the system will be a reduction in labor cost and an improved product yield. 3. 0000061182 00000 n 0000027039 00000 n A decision tree of any size will always combine (a) action choices with (b) different possible events or results of action which are partially affected by chance or other uncontrollable circumstances. 0000082692 00000 n Let us take a slightly more complicated situation: You are trying to decide whether to approve a development budget for an improved product.

0000068121 00000 n 4. The unique feature of the decision tree is that it allows management to combine analytical techniques such as discounted cash flow and present value methods with a clear portrayal of the impact of future decision alternatives and events. 0000003927 00000 n 0000006271 00000 n _v1eqAga}#,D@]Tfa#B=4I4(gc$8W'Vz= endstream endobj 7 0 obj <>stream Exhibit III. This is all that must be decided now. These outcomes, too, are based on your present information. endstream endobj 314 0 obj <>stream 0000039470 00000 n 0000044776 00000 n 0000078207 00000 n 0000021479 00000 n Practical ways to improve your decision-making process.

0000004111 00000 n 0000031280 00000 n Access more than 40 courses trusted by Fortune 500 companies. 0000064187 00000 n 0000015704 00000 n 0000019601 00000 n Since the discounted expected value of the no-expansion alternative is higher, that figure becomes the position value of Decision #2 this time. 0000006504 00000 n 0000035127 00000 n 0000064499 00000 n 0000025090 00000 n 0000037128 00000 n 0000018904 00000 n @ (I use the term investment in a broad sense, referring to outlays not only for new plants and equipment but also for large, risky orders, special marketing facilities, research programs, and other purposes.) 0000027814 00000 n 0000067679 00000 n Identify the points of decision and alternatives available at each point. 0000004982 00000 n G0 ;3pb$qH%E](e4y?2iW%XL{07%|ON(c/; NV^ 0000001088 00000 n endstream endobj 9 0 obj <>stream d"%Fp>4( <> If demand is high and the company does not expand within the first two years, competitive products will surely be introduced. Exhibit V. Analysis of Possible Decision #2 (Using Maximum Expected Total Cash Flow as Criterion). When decision trees are used, the discounting procedure can be applied one stage at a time. At the right of the branches in the top half we see the yields for various events if a big plant is built (these are simply the figures in Exhibit IV multiplied out). In many cases, the uncertain elements do take the form of discrete, single-variable alternatives. xref 0000041005 00000 n 0000045320 00000 n 0000028134 00000 n 0000024498 00000 n 0000000856 00000 n 0000014708 00000 n This tree is a different way of displaying the same information shown in the payoff table. 0000079649 00000 n 0000003619 00000 n A decision, for example, to build a more efficient plant will open possibilities for an expanded market. #~fGu=,vI{QR;;$CFQKJ$O_=X2\c)B}0|k' P#i@z uZ8/@OSoV#J :o{'XO.Yx xb```g@(Acsl[*,.v.`d8 {GPQj|E1 no][P'vRs,x2v&Xv'Lc5,de C"94&t?q"8to]eVdr 1E o|cx %PDF-1.6 % >> 0000074043 00000 n << 0000048499 00000 n 0000001698 00000 n 0000024893 00000 n 0000020861 00000 n We have not reached that stage, and perhaps we never will. But the tree will show management what decision today will contribute most to its long-term goals. X : b@s'*Hic7+PDVM|d/H)q[ The development department, particularly the development project engineer, is pushing to build the large-scale plant to exploit the first major product development the department has produced in some years. 0000028968 00000 n 0000059197 00000 n $8E'n(Z1E:~@7ZWlB2?qF7 {&?rcjiQ~~yiLS!Yt7(0>xFD!t}O Countless executives want to make them betterbut how? %PDF-1.3 % HBR Learnings online leadership training helps you hone your skills with courses like Decision Making. 0000006151 00000 n 0000062561 00000 n Possibly demand will be [], A version of this article appeared in the. 0000015321 00000 n Exhibit VII. 0000083340 00000 n 0000053189 00000 n An immediate decision is often one of a sequence. 0000070073 00000 n endstream We are expecting another article by Mr. Magee in a forthcoming issue.The Editors, The management of a company that I shall call Stygian Chemical Industries, Ltd., must decide whether to build a small plant or a large one to manufacture a new product with an expected market life of ten years. 4. I have sought to avoid unnecessary complication while putting emphasis on the key interrelationships among the present decision, future choices, and the intervening uncertainties. O_VT&Z]'ny|r8kQzu_[h/!.hJ; 32V(G@6%]O)5 vtdqs [L2RSEH+L.q:H6;B[?9nChz5uB? 0000007055 00000 n The chairman, a principal stockholder, is wary of the possibility of large unneeded plant capacity. 0000058251 00000 n 0000081418 00000 n The Stygian Chemical problem, oversimplified as it is, illustrates the uncertainties and issues that business management must resolve in making investment decisions. 0000071237 00000 n

296 20

Peter F. Drucker has succinctly expressed the relation between present planning and future events: Long-range planning does not deal with future decisions. The company grew rapidly during the 1950s; it kept pace with the chemical industry generally. 0000001942 00000 n

The management of a company that I shall call Stygian Chemical Industries, Ltd., must decide whether to build a small plant or a large one to manufacture a new product with an expected market life of ten years. 0000004247 00000 n

Y20E*eRc7IZ

-$Qb@`+ 0000035909 00000 n

0000011018 00000 n

It may be one of a number of sequences.

296 0 obj

<>

endobj

d$Qyu.]0&4y1 ,o%

@R~\V4U\'ki[r

E`H Stated in another way, it is worth $2,672 thousand to Stygian Chemical to get to the position where it can make Decision #2. 0000074585 00000 n

0000050962 00000 n

<>>>

hbbd``b` A@)HH0; 4Hl7j Q$dx&FQ? 0000005473 00000 n

296 20

Peter F. Drucker has succinctly expressed the relation between present planning and future events: Long-range planning does not deal with future decisions. The company grew rapidly during the 1950s; it kept pace with the chemical industry generally. 0000001942 00000 n

The management of a company that I shall call Stygian Chemical Industries, Ltd., must decide whether to build a small plant or a large one to manufacture a new product with an expected market life of ten years. 0000004247 00000 n

Y20E*eRc7IZ

-$Qb@`+ 0000035909 00000 n

0000011018 00000 n

It may be one of a number of sequences.

296 0 obj

<>

endobj

d$Qyu.]0&4y1 ,o%

@R~\V4U\'ki[r

E`H Stated in another way, it is worth $2,672 thousand to Stygian Chemical to get to the position where it can make Decision #2. 0000074585 00000 n

0000050962 00000 n

<>>>

hbbd``b` A@)HH0; 4Hl7j Q$dx&FQ? 0000005473 00000 n

0000000696 00000 n

The impact of the present decision in narrowing down future alternatives and the effect of future alternatives in affecting the value of the present choice must both be considered. The division would have a chance to retain more of the most profitable operations itself, exploiting some technical developments it has made (on the basis of which it got the contract). Following a decision to proceed with the project, if development is successful, is a second stage of decision at Point A. 0000052776 00000 n

Some major uncertainties are: the cost-volume relationships under the alternative manufacturing methods; the size and structure of the future marketthis depends in part on cost, but the degree and extent of dependence are unknown; and the possibilities of competitive developments which would render the product competitively or technologically obsolete. 0000065391 00000 n

Of course, the gains must be viewed with the risks. 0000038268 00000 n

WX|z I:t4g:MW0qaRo!gW6.5nyM>RJ'ZmnR3AH!,n m(v"Y}R-5t{N \H0HPboh89{=7c @sbX-}=0O;~D

q{XtCu=H/8 P}` cj=q=p Q7Fhy&v$C`>vt3s}z <<86696C4D038DD0418E522A56D77A7682>]>>

For simplicity, let us assume that a discount rate of 10% per year for all stages is decided on by Stygian Chemicals management. 0000044422 00000 n

In effect you say, If what I know now is true then, this is what will happen., Of course, you do not try to identify all the events that can happen or all the decisions you will have to make on a subject under analysis. 0000045928 00000 n

0000031721 00000 n

0000002891 00000 n

The problem is posed in terms of a tree of decisions.1. 0000063378 00000 n

Decision Tree with Financial Data. At any stage, we may have to weigh differences in immediate cost or revenue against differences in value at the next stage.

0000000696 00000 n

The impact of the present decision in narrowing down future alternatives and the effect of future alternatives in affecting the value of the present choice must both be considered. The division would have a chance to retain more of the most profitable operations itself, exploiting some technical developments it has made (on the basis of which it got the contract). Following a decision to proceed with the project, if development is successful, is a second stage of decision at Point A. 0000052776 00000 n

Some major uncertainties are: the cost-volume relationships under the alternative manufacturing methods; the size and structure of the future marketthis depends in part on cost, but the degree and extent of dependence are unknown; and the possibilities of competitive developments which would render the product competitively or technologically obsolete. 0000065391 00000 n

Of course, the gains must be viewed with the risks. 0000038268 00000 n

WX|z I:t4g:MW0qaRo!gW6.5nyM>RJ'ZmnR3AH!,n m(v"Y}R-5t{N \H0HPboh89{=7c @sbX-}=0O;~D

q{XtCu=H/8 P}` cj=q=p Q7Fhy&v$C`>vt3s}z <<86696C4D038DD0418E522A56D77A7682>]>>

For simplicity, let us assume that a discount rate of 10% per year for all stages is decided on by Stygian Chemicals management. 0000044422 00000 n

In effect you say, If what I know now is true then, this is what will happen., Of course, you do not try to identify all the events that can happen or all the decisions you will have to make on a subject under analysis. 0000045928 00000 n

0000031721 00000 n

0000002891 00000 n

The problem is posed in terms of a tree of decisions.1. 0000063378 00000 n

Decision Tree with Financial Data. At any stage, we may have to weigh differences in immediate cost or revenue against differences in value at the next stage. 0000030764 00000 n 0000248902 00000 n 0000004025 00000 n Will it achieve the economies expected? 0000052244 00000 n The initial decision alternatives are (a) to install the proposed control system, (b) postpone action until trends in the market and/or competition become clearer, or (c) initiate more investigation or an independent evaluation. >> Figure A illustrates the situation. 0000005604 00000 n y'$#kW} Note that in this case the chance alternatives are somewhat influenced by the decision made. The decision tree can clarify for management, as can no other analytical tool that I know of, the choices, risks, objectives, monetary gains, and information needs involved in an investment problem. For example, the military products division of a diversified firm, after some period of low profits due to intense competition, has won a contract to produce a new type of military engine suitable for Army transport vehicles. 0000002559 00000 n The position value of a decision is the expected value of the preferred branch (in this case, the plant-expansion fork). In these cases, we have found that the range of variability or the likelihood of the cash flow falling in a given range during a stage can be calculated readily from knowledge of the key variables and the uncertainties surrounding them. 0000030289 00000 n

105 0 obj <> endobj What about taking differences in the time of future earnings into account?

0000057966 00000 n There is also the possibility, indicated by Line C, of a large additional commercial market for the product, this possibility being somewhat dependent on the cost at which the product can be made and sold. 0000056019 00000 n Let us suppose it is a rather overcast Saturday morning, and you have 75 people coming for cocktails in the afternoon. 0000080468 00000 n Decision Tree with Chains of Actions and Events, Your initial decision is shown at the left. 0000013264 00000 n If the company builds a big plant, it must live with it whatever the size of market demand. You are urged to do so on the grounds that the development, if successful, will give you a competitive edge, but if you do not develop the product, your competitor mayand may seriously damage your market share. 0000004018 00000 n 0000070375 00000 n

2. The tool for this next step in the analysis is the concept of rollback.. 0000040480 00000 n

0000020572 00000 n

stream 0000062057 00000 n

0000250437 00000 n

If the small plant were expanded to meet sustained high demand, it would yield $700,000 cash flow annually, and so would be less efficient than a large plant built initially. 0000082415 00000 n

2. The tool for this next step in the analysis is the concept of rollback.. 0000040480 00000 n

0000020572 00000 n

stream 0000062057 00000 n

0000250437 00000 n

If the small plant were expanded to meet sustained high demand, it would yield $700,000 cash flow annually, and so would be less efficient than a large plant built initially. 0000082415 00000 n

`UYycNB3F5 QDuW1%R`7WTZ\S"!cQ(zdf7a`"N2,~m~#vi.0*,z5(b=s9m_fL7:g/oS#|_O\mLA5](A@(D$3x|Jx8sAC$~Dbo.%A_4~uGUMfS{w+N{L:l,NlN%(}bK,BHS R!1:irqDo*%"|C:XXt5)M{%5ntSMN@pOsy[iWn*#3IB{;" DzZI-,dW)7c7sk,rQfCezuwc]Z]2(33H_:; ;y5xp9G,(- 0000034615 00000 n 0000020624 00000 n In the case of postponement or further study, the decisions are to install, postpone, or restudy; in the case of installation, the decisions are to continue operation or abandon. But if the company chooses to build a small plant and then finds demand high during the initial period, it can in two yearsat Decision #2choose to expand its plant. The discount percentage is, in effect, an allowance for the cost of capital and is similar to the use of a discount rate in the present value or discounted cash flow techniques already well known to businessmen. 0000075764 00000 n 0000042943 00000 n

endstream endobj 6 0 obj <>stream 0000048997 00000 n GU`loSM71@= HV]o6}4?D-C]b3:Yr%A~%%qVyEs7&'sUNP`rYM&(zxysjqB2Viy0*4vnZ"aKLl|||iqyICi~]UU}qvYXn[Yj>pY1XEYqIx1m3Yb&++EaKOL-^je]rU3tt"~C>RDW$(@&%0(\6~W C&xnacMWakw7c_a3-D#w;J={MBup31o6@dK)Y-}M3dsLi5k/Cw M=Vw\c]j6T4Y,"z%r*$VfCBtIhoE8b"`r:#tHU *^\. 0000066443 00000 n B% 0000076385 00000 n Exhibit I illustrates a decision tree for the cocktail party problem. He favors a smaller plant commitment, but recognizes that later expansion to meet high-volume demand would require more investment and be less efficient to operate. 0000068552 00000 n 0000034190 00000 n It deals with the futurity of present decisions.2 Todays decision should be made in light of the anticipated effect it and the outcome of uncertain events will have on future values and decisions. 0000069561 00000 n 0000006215 00000 n 0000018051 00000 n 0000001193 00000 n In others, however, the possibilities for cash flow during a stage may range through a whole spectrum and may depend on a number of independent or partially related variables subject to chance influencescost, demand, yield, economic climate, and so forth.

If we reduce all these yields by their probabilities, we get the following comparison: Build big plant: ($10 .60) + ($2.8 .10) + ($1 .30) $3 = $3,600 thousand, Build small plant: ($3.6 .70) + ($4 .30) $1.3 = $2,400 thousand, Exhibit VI. 0000090962 00000 n 0000060560 00000 n The reason is the following: We need to be able to put a monetary value on Decision #2 in order to roll back to Decision #1 and compare the gain from taking the lower branch (Build Small Plant) with the gain from taking the upper branch (Build Big Plant). At Stygian Chemical, as at many corporations, managers have different points of view toward risk; hence they will draw different conclusions in the circumstances described by the decision tree shown in Exhibit IV. It might subcontract all fabrication and set up a simple assembly with limited need for investment in plant and equipment; the costs would tend to be relatively high and the companys investment and profit opportunity would be limited, but the company assets which are at risk would also be limited. The nature of the riskas each individual sees itwill affect not only the assumptions he is willing to make but also the strategy he will follow in dealing with the risk. A large plant with high volume would yield $1,000,000 annually in cash flow. Following this plan would improve the chances for a continuation of the military contract and penetration into the commercial market and would improve the profitability of whatever business might be obtained in these markets. ~S9p?C=&" eHPwv.9 ew-.04A BXp #|EX8.v@! Hb```f``Y @Q 0000055436 00000 n 9 endstream endobj startxref 0 %%EOF 168 0 obj <>stream ek~"o~N`2&% 4R3#n90X(f g. 0000001791 00000 n Unless these differences are recognized and dealt with, those who must make the decision, pay for it, supply data and analyses to it, and live with it will judge the issue, relevance of data, need for analysis, and criterion of success in different and conflicting ways. 0000007034 00000 n 0000066990 00000 n At the time of making Decision #1 (see Exhibit IV), management does not have to make Decision #2 and does not even know if it will have the occasion to do so. 0000076047 00000 n Optimal Investment Decisions: Rules for Action and Criteria for Choice (Englewood Cliffs, New Jersey, Prentice-Hall, Inc., 1962), p. 250. What would this investment yield? Exhibit II. 0000020160 00000 n 0000056658 00000 n 0000073531 00000 n The choice which maximizes expected total cash yield at Decision #1, therefore, is to build the big plant initially. Are they going to mechanize anyway? Accelerate your career with Harvard ManageMentor. uek]0l>`h}?xeX'lHw;lyw*`l-LW>khv. Bear in mind that nothing is shown here which Stygian Chemicals executives did not know before; no numbers have been pulled out of hats. 0000058935 00000 n 0000027336 00000 n f^jinF~g#sL:'/-E(+&,{D`(tDFFD CA"E4 D^aix"|{0o _ +!gJn#*_3Zw 0000001514 00000 n 0000033000 00000 n 0000025317 00000 n Note: For simplicity, the first year cash flow is not discounted, the second year cash flow is discounted one year, and so on. Long-Range Planning, Management Science, April 1959, p. 239.

0000005986 00000 n trailer 0000079888 00000 n The calculations are shown in Exhibit VIII. On the other hand, if you set up the party for the garden and after all the guests are assembled it begins to rain, the refreshments will be ruined, your guests will get damp, and you will heartily wish you had decided to have the party in the house. endobj 0000071250 00000 n U"@mY'aQxZ&V0G5x( gJY~e1? 315 0 obj <>stream 0000057685 00000 n Using the decision tree, management can consider various courses of action with greater ease and clarity. 0000004049 00000 n 0000068069 00000 n 0000065907 00000 n /z)X%3G}m3N]nIIg5eCm|&w`^ =yHEdVYV}_6"V5^eF,LO:ijyma[j{;6n~?oKY>J 0000015167 00000 n j(*`od%F$TwcQEQEWA4D#v mAcgp'F? =sYdp;{N (HS>y`dgd(ZcsF_ZyY21'yqCEQE-. You have a pleasant garden and your house is not too large; so if the weather permits, you would like to set up the refreshments in the garden and have the party there.

This resolution will lead in turn to a new decision. 0000008476 00000 n Later in this article we shall return to the problem facing Stygian Chemical and see how management can proceed to solve it by using decision trees. 0000031037 00000 n 0000030457 00000 n

xuVKs6WVj&VH,w$u[O;Zfl/@P' HxyMr|^]Y['y`idN]r}['miL (UZqfy_!~YbOT4ob:mN3zY1?V^N:ud%y:38QbN^-z}@['#C GR;4\4yV^{mWLvjwVsQesi'2O ]]Z&Lt0V{fIY"h B A)Dz%*Q#"6+:z U=8.H`%kVK'OyOWv^SQ1us \Ho!yX;o1kQ K:o,jps'I?2@XcAJHL o$nB!NY/@7i2fciGp~4yim 0000035695 00000 n Here, as in similar cases, it is not a bad exercise to think through who the parties to an investment decision are and to try to make these assessments: Considerations such as the foregoing will surely enter into top managements thinking, and the decision tree in Exhibit IV will not eliminate them. (The market would be larger than under Alternative 3, but would be divided up among more competitors.). 0000013755 00000 n 0000001687 00000 n endobj 0000001580 00000 n 0000073866 00000 n This particular decision can be represented in the form of a payoff table: Much more complex decision questions can be portrayed in payoff table form.